Dedicated, hard-working public servants are at the heart of state government. You provide the fundamental services upon which Rhode Islanders rely and effectively operate the government functions that propel the state forward.

Our individual responsibilities are diverse – from maintaining the state’s roads and bridges and pristine natural resources to educating and training Rhode Islanders to attain gainful employment – but we all share a common goal: Making the state a better place to work, live, recreate and do business. I thank you for your belief in our mission and doing your part to make it possible.

Below are each of the Executive Branch state agencies and a summary of the services they provide to the citizens of Rhode Island.

The Department of Administration was created in 1951 to consolidate and centralize finance, purchasing and management aspects of state government. It maintains two primary functions: the delivery of core business services and oversight of state agency operations. It is the goal of the Department to deliver services to agencies through processes that are predictable, equitable, efficient and cost-effective so that all Executive Branch agencies can best serve Rhode Islanders. Core business services include the Division of Human Resources, Enterprise Technology Strategy & Services (ETSS), the Division of Capital Asset Management and Maintenance (DCAMM), and the Division of Purchases. Additionally, the Department’s Office of Management and Budget (OMB), Office of Diversity, Equity and Opportunity (ODEO), Division of Statewide Planning, Office of Accounts and Control, and Legal Services Office serve the Department’s mission to deliver strategic and effective oversight and accountability of agency operations. Specialized business units within the Department include the Office of Energy Resources and HealthSource RI, the state-run health exchange.

The Department of Business Regulation’s primary function is to implement state laws mandating the regulation and licensing of designated businesses, professions, occupations and other specified activities. The department is composed of five divisions and Central Management, which includes the budget, regulatory standards, compliance and enforcement. The respective divisions are: Banking, Securities, Insurance, Building, Design and Fire Professionals, Commercial Licensing and Gaming and Athletics Licensing, and the Office of the Health Insurance Commissioner. The Director of Business Regulation is appointed by the Governor and serves statutorily as the State Banking Commissioner, Commissioner of Insurance, Real Estate Administrator, Chief of Intoxicating Beverages, and State Boxing Commissioner. The Department also houses other commissions including the Real Estate Commission, Real Estate Appraisal Board, Rhode Island Board of Accountancy, the Certified Constables’ Board, and the Racing and Athletics Hearing Board. The Department issues over 200,000 licenses and conducts administrative hearings involving issuances, administrative penalties, denials, suspensions and/or revocations.

The Executive Office of Health and Human Services (EOHHS) serves as “the principal agency of the executive branch of state government” (R.I.G.L. §42-7.2-2) responsible for overseeing the organization, finance and delivery of publicly funded health and human services. In this capacity, the EOHHS administers the state’s Medicaid program and provides strategic direction to Rhode Island’s four health and human services agencies: Department of Health (DOH); Human Services (DHS); Children, Youth, and Families (DCYF); and Behavioral Healthcare, Developmental Disabilities, and Hospitals (BHDDH). The EOHHS and the agencies under its umbrella provide direct services to over 300,000 Rhode Islanders. Additionally, the agencies deliver an array of regulatory, protective and health promotion services to our communities. EOHHS’ objectives are to manage the organization, design and delivery of health and human services and to develop and implement an efficient and accountable system of high quality, integrated health and human services.

The mission of the Rhode Island Department of Corrections (RIDOC) is to contribute to public safety by maintaining a balanced correctional system of institutional and community programs that provide a range of control and rehabilitative options for criminals. The population under Departmental jurisdiction includes all pretrial detainees, sentenced inmates, and offenders on probation or parole. RIDOC places a major emphasis on prisoner re-entry initiatives to reduce the incarcerated population and recidivism. In order to achieve public safety, it is essential that offenders released from RIDOC facilities and/or supervised on probation and parole are provided with sufficient skills to promote law-abiding behavior and that they are given effective post-release supervision for successful reintegration.

The Rhode Island Department of Environmental Management (DEM) serves as the chief steward of the state’s natural resources – from beautiful Narragansett Bay to our local waters and green spaces to the air we breathe. Our mission put simply is to protect, restore, and promote our environment to ensure Rhode Island remains a wonderful place to live, visit, and raise a family. We protect these precious resources through development and enforcement of environmental laws, and we strive to provide guidance to our many customers in complying with these laws. We work with our partners to restore our lands and waters, to conserve wildlife and marine resources, and to monitor environmental quality so we can build healthy, more resilient communities. We promote our natural resources – from our historic parks and beaches to our farms and delicious local food and seafood. We are focused on helping our state grow “green” and build desirable neighborhoods that offer ample space to recreate and connect with nature.

The Rhode Island Department of Revenue is responsible for ensuring the proper functioning of state government through the collection and distribution of state revenue, operation of the state lottery, oversight of municipal finance, and administration of state laws governing driver licensing, motor vehicle sales and motor vehicle registration. The collective mission of the Department of Revenue is to administer its programs and consistently execute the laws and regulations with integrity and accountability, thereby instilling public confidence in the work performed by the Department.

The Rhode Island Lottery operates and oversees all aspects of Lottery operations and gaming in the State. The mission of the Rhode Island Lottery is to generate revenue for the State of Rhode Island through the responsible management and sale of entertaining lottery products.

The Division of Taxation administers and collects all taxes as required by Rhode Island law in the most efficient and cost-effective manner and assists taxpayers by helping them understand and meet their tax responsibilities.

The Division of Motor Vehicles is responsible for ensuring consistent administration and enforcement of all laws pertaining to motor vehicle and is committed to providing excellent customer service with integrity and transparency. Under the direction of the Administrator, the Division administers motor vehicle titling, registration and licensing laws, transportation safety laws, motor vehicle franchise dealer and manufacturer laws, and other motor vehicle-related laws and regulations.

Other divisions within DOR include the Division of Municipal Finance (DMF), Office of Revenue Analysis (ORA), Central Collections Unit (CCU), and Revenue Director's Office.

The Rhode Island Emergency Management was created in 1941 as the “The Rhode Island State Council of Defense” per Rhode Island Public Law Chapter 990. Since its founding, the primary mission of the Rhode Island Emergency Management Agency (RIEMA) has been to protect life and property in the event of a disaster or crisis situation. The agency provides a structure for statewide coordination through its Comprehensive Emergency Management Program which enhances Rhode Island’s capacity to prepare for, respond to, recover from, and mitigate against all hazards and threats. Guided by these four principles, RIEMA continues to make great strides to improve emergency preparedness in the State of Rhode Island.

The Department of Labor and Training (DLT) is the state workforce development and labor department. The DLT has three primary functions: ensure workers, employers and citizens have the tools and training necessary to succeed in the Rhode Island economy; protect Rhode Island’s workforce through the enforcement of labor laws, prevailing wage rates and workplace health and safety standards; and provide temporary income support to unemployed and temporarily disabled workers. The DLT has six divisions: Business Affairs, Workforce Development Services, Labor Market Information, Income Support: Unemployment Insurance/ Temporary Disability Insurance, Workers’ Compensation and Workforce Regulation Services. The Executive Office consists of the Office of the Director, Communications, the Governor’s Workforce Board Rhode Island, Policy/Legislative Affairs and Adjudication. Other satellite business functions include the Board of Review, the Local Workforce Offices – Providence/Cranston, West Warwick, Woonsocket and Wakefield and the Arrigan Center.

The mission of the Rhode Island Department of Health (RIDOH) is to protect and promote the health of Rhode Islanders. Everyone should have the opportunity to be as healthy in possible, in the healthiest community as possible, regardless of their ZIP code. Rhode Island is one of only a few states in the country that does not have local public health departments, which makes the scope of this State agency very broad. The leading priorities of the Department are to 1) address the socioeconomic and environmental determinants of health, 2) eliminate the disparities of health and promote health equity, and 3) ensure access to quality health services for all Rhode Islanders, including our most vulnerable populations. This work is carried out through six core divisions and two institutes: the Division of Policy, Information, and Communications; the Division of State Laboratories and Medical Examiners; the Division of Preparedness, Response, Infectious Disease, and Emergency Medical Services; the Division of Community Health and Equity; the Division of Division of Environmental Health; the Division of Customer Services; the RIDOH Academic Institute; and the Health Equity Institute. Health Department staff are charged with promoting healthy lifestyle changes; ensuring that food and water in our state are healthy and safe; preparing for and responding to public health emergencies, such as emerging diseases and the health effects of natural disasters; preventing the spread of infectious diseases; curbing the opioid epidemic; regulating hundreds of healthcare facilities and tens of thousands of healthcare professionals; and running the State’s only medical examiner’s office. To support this work, the Department operates the State Health Laboratories, serves as a hub for critical public health data, fosters partnerships with the state’s academic institutes, and communicates essential public health information to our many partners and the public.

The Rhode Island Department of Transportation (RIDOT) designs, constructs, and maintains the state's surface transportation system. This includes not only roads and bridges but also the state's rail stations, tolling program, bike paths and ferry service.

In 2016, with the passage of the sweeping RhodeWorks legislation, the department underwent a complete restructuring as mandated by the legislation. As part of this restructuring, RIDOT developed the first ever 10-year transportation plan for the state and has adopted unprecedented accountability measures. The $5 billion RhodeWorks program provides for the planning, execution, management and funding to bring Rhode Island's infrastructure into a state of good repair by the year 2025. RIDOT is now in its fourth year of implementing RhodeWorks and has achieved significant results, to include the preservation and reconstruction of 191 bridges for an investment of $218.86 million in 52 projects, the paving of 100 miles of roadway for $81.26 million in 29 projects and the launching of the first-in-the-nation large tractor trailer truck only tolling system.

In 2019, RIDOT will have 77 active projects with a construction value of $715.6 million. These projects will include a combination of bridge repair, replacement, and preservation activities on 177 bridges.

The Department of Behavioral Healthcare, Developmental Disabilities & Hospitals (BHDDH) touches the lives of more than 50,000 Rhode Islanders living with mental illness and/or substance use disorders, those who have intellectual and/or developmental disabilities or need Long-Term Acute Care in the state hospital system, known as the Eleanor Slater Hospital. BHDDH has three major operational divisions: Behavioral Healthcare, Developmental Disabilities, and Eleanor Slater Hospital. The Department works to ensure that all Rhode Islanders have the opportunity to enjoy the best possible behavioral health and well-being, with full access to the benefits of community living in the most integrated setting appropriate for their needs. The Department is responsible for running a responsive, caring and efficient system of person-centered services using themes of wellness, recovery, and parity to combat stigma and move closer to an inclusive society. The Department works to create safe, accessible, high quality and integrated services for all Rhode Islanders, while collaborating with community partners for those in need of assistance. This also means building capacity, so Rhode Islanders know that every door will be the right door for care.

Through the compassionate delivery of critical safety net and other supportive services, the Rhode Island Department of Human Services (DHS) is committed to ensuring that individuals and families in Rhode Island have access to the supports they need to achieve their goals. Its vision is that all Rhode Islanders have the opportunity to thrive at home, work and in the community. DHS works hand-in-hand with community partners and resources throughout Rhode Island to deliver these benefits to more than 300,000 families, adults, children, elders, individuals with disabilities and veterans every year as well as make a lasting, positive impact on the State’s health and future.

The Department of Public Safety oversees all of the State of Rhode Island’s public safety agencies to ensure efficient delivery of the services those agencies provide. These public safety agencies include the Rhode Island State Police, E 9-1-1 Uniform Emergency Telephone System, Rhode Island Capitol Police, Rhode Island Municipal Police Training Academy, Rhode Island Division of Sheriffs, and Public Safety Grants Administration Office. The department also has a Central Management Office and Office of Legal Counsel.

The Department of Children, Youth and Families is the state child welfare, children's mental health and juvenile corrections services agency which promotes safety, permanence, and well-being of children through partnerships with family, community, and government.

The Department also plans and implements support programs and service delivery systems which will achieve the goals of developing the full potential of children in care. The Department is the agency which services families with children who have been or are at risk of being abused, neglected, wayward, or delinquent.

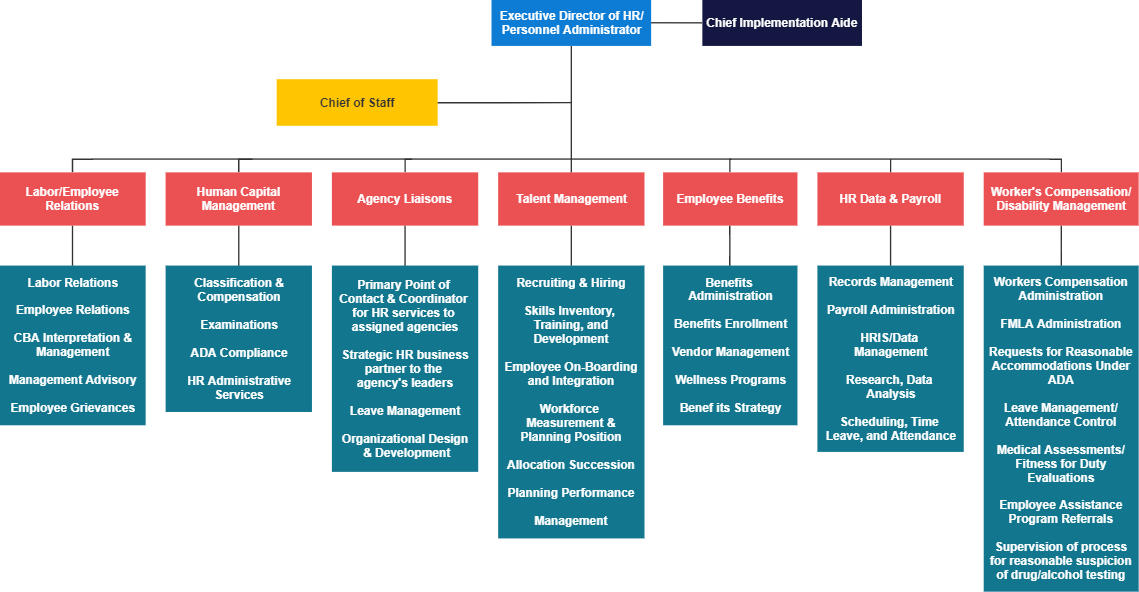

To make State Government an Employer of Choice in the State of Rhode Island by building, maintaining, developing and providing services to a skilled workforce committed to excellence that reflects the diversity and talent of our community. To provide Human Resources service to all State Departments in support of their missions. To continually assess and enhance the services provided to ensure efficiency, appropriateness and cost effectiveness.

Service * Commitment * Dedication

This handbook is provided only as guidance to employees of the Executive Branch on some of the State’s employment benefits and policies. This handbook should not be construed to be all inclusive. The handbook is not intended to replace, override or modify any federal or state law; any promulgated rule or regulation, including without limitation the State’s Personnel Rules; and/or the express terms of a collective bargaining agreement.

Nothing contained within this handbook is intended to create, nor shall it be considered to: (1) create a contract between the State, it’s employees or applicants for employment, or any party doing business with the State; (2) create any legal or contractual obligation on the part of the State; (3) create any rights or other entitlements, contractual or otherwise, on the part of any employee or establish any past practice; (4) modify any existing or future employment relationship, including existing “at-will” employment relationships, between State, its employees or applicants for employment; and/or (5) modify or limit in any way the ability or grounds for which the State may terminate the employment of any of its employees.

The State reserves the right, in its sole discretion, to interpret, supplement, deviate from and/or suspend any of the provisions in this handbook, at any time, with or without notice. The State also reserves the right to amend this handbook, at any time, with or without notice, by modifying its existing provisions, deleting, in whole or in part, its existing provisions, and/or adding new provisions, except as would otherwise be expressly prohibited by law, rule or applicable collective bargaining agreements.

This Disclaimer applies to this, or any and all other department handbooks. This handbook completely supersedes all handbooks issued or published prior to the effective date of this handbook.

Visit ApplyRI today and review our wide range of employment opportunities and help make a difference in the State of Rhode Island

Rhode Island is the smallest state of the union. The state is one of the most densely populated and heavily industrialized for its size. For a state that is only 37 miles wide and 48 miles long, it is notable that its shoreline on Narragansett Bay in the Atlantic Ocean runs for 400 miles. Indeed, one of Rhode Island's nicknames is "the Ocean State."

The legendary mansions of Newport overlook the ocean at Narragansett Bay. Many of these spectacular homes are open for tourists and offer an inside glimpse into the lives of America's high society. The Breakers, the magnificent Vanderbilt mansion built in 1895, is one of the most elegant private homes that has ever graced the Newport shorefront.

This state was named by Dutch explorer Adrian Block. He named it "Roodt Eylandt" meaning "red island" in reference to the red clay that lined the shore. The name was later anglicized when the region came under British rule.

The Ocean State

(Official) This nickname was formulated to attract tourism to Rhode Island and appears on non-commercial license plates. "Ocean State" began appearing on Rhode Island license plates in 1972, replacing "Discover." The Rhode Island Tourism Division promotes over 400 miles of coastline. This is not all ocean frontage but includes Narragansett Bay extending inland from the Atlantic Ocean north to the center of the state. All Rhode Islanders live within a 30-minute drive to the Atlantic Ocean or Narragansett Bay.

Little Rhody

A traditional nickname for Rhode Island, obviously in reference to the state's small size. Rhode Island is the smallest of the 50 states in area. Variations include "Little Rhodie," "L'il Rhody," and "Little Rhode."

The Smallest State

This sobriquet* for Rhode Island, like the nickname "Little Rhody," is in reference to Rhode Island's size.

Land of Roger Williams

Roger Williams, who founded Providence Plantation in 1636, is the source of this sobriquet.

The Southern Gateway of New England

This historical nickname was bestowed because Rhode Island was the most southerly of the New England states with harbors suitable for ocean-going ships. These harbors allowed New England raw materials and finished goods to be shipped to other parts of the United State and foreign countries and allowed raw and finished goods from other parts of the United States and foreign countries to be delivered to New England.

Source: Shearer, Benjamin F. and Barbara S. State Names, Seals, Flags and Symbols Greenwood Press, Westport, Connecticut - 1994 Shankle, George Earlie, Phd State Names, Flags, Seals, Songs, Birds, Flowers and Other Symbols H. H. Wilson Company, New York - 1938 (Reprint)

"Rhode Island Taking Shape & Shaping History" Rhode Island Timeline Courtesy of http://sos.ri.gov/

Below are topic areas relevant to your employment with the State of Rhode Island. Content in this section will be continually updated and expanded in the effort to provide employees with necessary and relevant information regarding workplace policies and expectations.

It is important to note that the purpose of this section is to provide guidance to employees and is not a complete review of all policies and procedures that pertain to state employment. However, this section should provide answers to many of your questions about your personal responsibilities and the benefits of working for the State of Rhode Island.

Many State agencies and/or programs have policies and/or directives that expressly apply only to the employees within that agency or program given the nature of the work performed and requirements necessary to conduct that business. In many cases, you will be provided those policies and/or directives by the program manager. We encourage employees to ask their supervisor about any such policies/directives.

The Division of Information Technology (DOIT) has an Acceptable Use Policy to ensure that employees, interns, consultants, vendors, contracted individuals, and any entity with authorized access to State information systems and data have a clear understanding of what is considered to be the acceptable and proper use of State-owned hardware and software, computer network access and usage, internet and email usage, telephony, and security and privacy for users of the State of Rhode Island Wide Area Network.

The use of State network resources are monitored and users have no right to or expectation of privacy when using State network resources. Use of State network resources are restricted to conduct authorized State business only.

For full details of the policy visit: Technology Acceptable Use Policy.

The Department of Administration has a Policy on Social Networking that establishes guidelines for State agencies, departments, vendors, employees and any individuals with access rights to the State's networks regarding the use of Social Networking sites, including, but not limited to, Facebook, MySpace, Twitter, Instagram, Reddit, YouTube, LinkedIn and Blogger.

It is expected that all employees dress in an appropriate and professional manner. Many agencies have policies regarding appropriate dress, some of which are specific to certain positions due to the nature of the work performed and requirements necessary to conduct that business. See the section entitled “Agency Specific Policies and Directives.”

Generally speaking, and unless covered by an agency specific policy or directive, appropriate wear within an office environment includes but is not limited to suits or sports jackets, dress slacks, ties, tailored dresses, skirts and blouses. All employees are expected to wear footwear appropriate for a professional office. Additionally, all clothing shall be clean and not excessively worn, frayed, tattered, wrinkled, soiled and/or torn. Law enforcement personnel are required to wear their designated uniform at all times during working hours.

Business casual days are at the discretion of the Director. Proper attire for a business casual day includes slacks, sport shirts, polo shirts and proper footwear. Shorts or beachwear is not permissible. As professionals and representatives of your department, we ask that you use good judgment when choosing your attire for a business casual day. Employees who are due to meet with the general public or required to appear where business attire is expected are obviously still expected to dress appropriately.

At all times, including normal business dress and/or business casual days, inappropriate dress includes but is not limited to jeans, shorts, exercise clothing, sweatshirts, sweat suits, t-shirts, sneakers or other leisure wear that does not belong in a business setting. Inappropriate footwear includes sneakers, unless permitted by a valid acceptable medical excuse.

Certain employees may be provided with a State-issued landline, cellular phone, or other portable communication devices if the duties and business goals will be advanced by the usage of said device. Employees who are provided with a State-issued cellular phone or other portable communications devices are required to keep the units turned on, updated and the batteries charged. Employees must have such devices in their possession when on duty or on call.

Landlines, State-issued cellular phones and other portable communication devices are for State business use only and should not be used as a substitute for a personal cellular phone or other portable communications device; however, incidental and infrequent use for personal reasons is allowed if the use is:

Please see the State Controller’s full policy on Usage of State-Issued Cellular Phones and Other State-Provided Portable Communications Devices at the following link: A-69 Usage of State-Issued Cellular Phones and Other State-Provided Portable Communications Devices.

The State of Rhode Island encourages individual employee participation in assisting non-profit community and charitable organizations in the effort to help those less fortunate and in need of assistance.

Yet due to the time-consuming nature of fundraising activities, any individuals wishing to assist such organizations may not do so on state time, using state leased or owned property, or acting in an official capacity unless they have received prior written authorization from their Agency Director and the State Personnel Administrator.

Fundraising solicitation would include activities such as distributing flyers, sending e-mails, or hanging posters.

Using State resources such as photocopy equipment, paper, computer equipment, or employee work time in individual solicitation efforts is strictly prohibited. Also, solicitation through e-mail without prior approval is prohibited.

This policy does not apply to employee participation in State-sponsored general campaigns with designated leadership, to include SECA.

In accordance with Personnel Rule 6.02, it is the duty of every employee to so conduct himself/herself inside and outside his/her office as to be worthy of the esteem a public employee must enjoy. That Rule states as follows:

Therefore it shall be the policy of the State of Rhode Island that no state employee shall engage in any outside business activities, however remote from the function of his/her office, which would in any way interfere with the employee’s performance of his/her regular duties, or embarrass or bring discredit to either the employee or the state. State employees who avoid or ignore this policy shall be subject to disciplinary action.

Furthermore, whenever a state employee shall so conduct himself/herself as to cause scandal or to lose or jeopardize such esteem, (s)he may be dismissed for the good of the service, subject to the provisions of the law and rules.

Similarly, in accordance with RIGL§ 36-14-1, it is the policy of the state of Rhode Island that public officials and employees must adhere to the highest standards of ethical conduct, respect the public trust and the rights of all persons, be open, accountable, responsive, avoid the appearance of impropriety, and not use their position for private gain or advantage. Behavior that discredits a Department and the State cannot and will not be tolerated.

Further, the Code of Ethics is comprised of a set of statutory and regulatory provisions which regulate the ethical conduct of elected and appointed public officials as well as state and municipal employees. To access specific sections of the Code, including those provisions regarding prohibited conduct, nepotism, gifts, and revolving door, see The Code of Ethics.

Harassment in the work place on the basis of race, color, religion, sex, national origin, age, disability, sexual orientation or gender identity or expression is not tolerated. Such harassment is against the law pursuant to the Fair Employment Practices Act, R.I.G.L 28-5-7.

The Rhode Island Commission for Human Rights and Equal Employment Opportunity Commission (EEOC) Guidelines define “harassment” as follows:

Harassment is verbal and/or physical conduct that denigrates or shows hostility or aversion toward an individual because of his or her race, color, religion, gender, national origin, age, disability or sexual orientation, or that of his or her relatives, friends or associates, and that: (1) has the purpose or effect of creating an intimidating, hostile or offensive work environment; (2) has the purpose or effect of unreasonably interfering with an individual’s work performance; or (3) otherwise adversely affects an individual’s employment opportunities.

Harassing conduct includes, but is not limited to, the following: (1) epithets, slurs, negative stereotyping, or threatening, intimidating or hostile acts that relate to race, color, religion, gender, national origin, age, disability, sexual orientation or gender identity or expression; and (2) written or graphic material that denigrates or shows hostility or aversion toward an individual or group because of race, color, religion, gender, national origin, age, disability, sexual orientation or gender identity or expression that is placed on walls, bulletin boards, or elsewhere on workplace premises, or in circulation in the work place, including, but not limited to e-mails and similar materials.

Retaliation against an individual for protesting harassment, for filing a charge of discrimination or for testifying or assisting in an investigation of a charge of discrimination is unlawful and strictly prohibited.

Each State Agency’s Affirmative Action Plan publication includes policies, practices and complaint procedures instituted to prevent and investigate claims of discrimination and harassment.

The federal Hatch Act, 5. U.S.C. §§ 1501 to 1508, restricts Executive Branch employees in any agency of State government whose principal employment is in connection with an activity financed, in whole or in part by federal loans or grants, from using their official authority or influence for the purpose of interfering with or affecting the result of an election or a nomination for office.

Subject to certain specified exceptions, the Hatch Act also prohibits state employees from being a candidate for any partisan elective office (regardless of jurisdiction) if the employee’s salary is entirely paid for by the federal government.

Please do not assume that either your job or your political activities are not subject to the Hatch Act. Should this Act apply to you, we recommend you seek an advisory opinion from the United States Office of Special Counsel.

In addition, Rhode Island General Laws, §§ 36-4-51 to 36-4-54, contain prohibitions on classified employees from seeking the nomination of or being a candidate for any elective State Office, and also contain prohibitions on classified employees running for partisan political office, campaigning for public officials during working hours, and soliciting political contributions for or being solicited for political campaigns. Violations of these statutes can result in demotion or dismissal.

The State of Rhode Island promotes a workplace that is free of sexual harassment. Sexual harassment of employees occurring in the workplace or in other settings related to their employment is unlawful and will not be tolerated. Any retaliation against an individual who has complained about sexual harassment or retaliation against individuals for cooperating with an investigation of a sexual harassment complaint is similarly unlawful and will not.be tolerated. To achieve a workplace free from sexual harassment, there are procedures by which inappropriate conduct will be dealt.

The State of Rhode Island takes allegations of sexual harassment seriously and will promptly respond to complaints of sexual harassment. Where it is determined that such inappropriate conduct has occurred, action shall be taken to prevent further offending conduct and impose timely corrective action as is necessary, up to and including disciplinary action where appropriate.

Please note that while this policy sets forth goals of promoting a workplace that is free of sexual harassment, the policy is not designed or intended to limit the authority to immediately impose discipline or take remedial action for workplace conduct deemed unacceptable, regardless of whether that conduct satisfies the definition of sexual harassment.

All employees are required to read and abide by the State’s Sexual Harassment Policy, which is located at the following link: Sexual Harassment Policy.

Licenses and similar certificates, registrations and permits (hereby collectively referred to as “license” and “licensure” for the purpose of this statement) from various state and/or federal regulatory bodies are required for employment in many positions at the State of Rhode Island. All personnel required to hold a license must provide current proof of a valid license as issued by an appropriate authority upon initial employment.

It is the responsibility of the individual employee to maintain the appropriate licensure during employment in positions where required and provide updated information to the Division of Human Resources in a timely manner. As such, employees must provide proof of licensure renewal on or before the renewal or expiration date.

Upon selection of a job candidate, the Division of Human Resources shall request applicable documentation and confirm that candidates are appropriately licensed.

For further information regarding the applicability, procedures and compliance of this policy, please review the full Licensure policy found here: Licensure Policy.

In accordance with RIGL § 28-5.1, equal opportunity and affirmative action toward its achievement is the policy of all units of Rhode Island state government, including all public and quasi-public agencies, commissions, boards and authorities, and in the classified, unclassified, and non-classified services of State employment. All policies, programs, and activities of state government shall be periodically reviewed and revised to assure their fidelity to this policy.

Each State agency has an Affirmative Action Plan publication that outlines numerous policies and practices instituted to ensure an equal opportunity/affirmative action environment.

The courts have imposed requirements regarding the preservation of documents, including electronic documents such as email that may be relevant in potential and pending lawsuits. The courts have imposed multi-million-dollar penalties, along with other sanctions, against companies and government agencies which do not have procedures in place to protect discoverable material. In addition, sanctions can be imposed against individual officials and employees within companies and government agencies for non-preservation or outright spoliation of evidence.

To ensure that the State is in compliance with these new rules, the Department of Administration, Division of Legal Services has promulgated a “Litigation Hold” policy which sets forth the authority and process for initiating, implementing, monitoring, and releasing litigation holds. This policy applies to all potential evidence in whatever form when litigation against a Department, or an employee acting within the scope of employment, has been filed or is reasonably anticipated or foreseeable. This policy also applies to litigation that has been filed, or is reasonably anticipated or foreseeable to be filed, on behalf of the Department.

This policy suspends any records retention policy that would otherwise authorize destruction, deletion or disposal of such potential evidence.

For further information, please review the full Litigation Hold Policy at : Litigation Hold Policy.

If you have any questions or comments about the litigation hold policy, the Division of Legal Service is available to discuss the subject with your representatives.

In accordance with the State’s policy statement on fraudulent practices, all State agencies, employees, vendors, contractors, outside agencies, or persons employed by or doing business with the State or in any other relationship with the State shall: (1) Adhere to the highest standards of ethical conduct; (2) Respect the public trust and the rights of all persons; (3) Be open, accountable, and responsive; (4) Avoid the appearance of impropriety; (5) Not use their position for private or personal gain; and, (6) Prevent, identify, and, report any fraud and or corruption observed during the conduct of any business by or with the State of Rhode Island.

For further information, please refer to the State’s Policy on Fraud and Fraudulent Practices which provides instruction for all State Agencies and their respective employees at: Fraud Policy.

When an employee is required, in writing by a superior, to work in a higher class of position for a period of three (3) consecutive days or more, that employee is entitled to receive the lowest salary rate of that higher class which will provide a pay increase of at least one step over his/her present base rate retroactive to the first day of such assignment. Employees on “Acting” assignments do not receive an increase in their biweekly pay. Payment for “Acting” assignments is made as a retroactive payroll adjustment for a specified time period.

For more information on “Acting Assignments”, please to Personnel Rules 4.0217 as well as applicable bargaining unit contracts.

Civil service examinations are administered to employees and/or prospective employees for competitive service positions in the classified branch of State service. Such examinations are governed by federal and state merit system principles, the Rhode Island Personnel Rules and policies/procedures established for examination.

Classified employees with temporary or provisional status are required to take the civil service examination for the class of position they hold and be reachable as defined in the Personnel Rules as being in the “top” six (6) for certification from the appropriate list (PR 4.0181). As required by the Personnel Rules, employees who are not reachable for certification shall be replaced.

All applications for examinations shall be made on a form prescribed by the Personnel Administrator and no application may be accepted after the close of the announced filing period.

The Personnel Administrator may deny admission to examination to any applicant, if the information contain in said application conclusively shows that the applicant has failed to present evidence that (s)he possesses sufficient qualifications to warrant examination, as set forth in the specifications for the class of position(s).

For more information, see Merit System Law (RIGL 36-4), the Personnel Rules, union contract (if applicable) or the Division of Human Resources website at: http://www.hr.ri.gov/

If an employee believes their assigned duties and responsibilities more closely resemble the job description of another classified classification rather than their current classification, they may complete and submit a classification questionnaire. This classification questionnaire will then be utilized as part of a desk audit study conducted by Human Resources. Following the completion of the desk audit study, Human Resources will make a recommendation to the employee’s Department or Agency as to the job classification that is the best fit for the employee’s duties and responsibilities.

Employees may obtain a classification questionnaire/desk audit form from their Human Resources representative.

For more information, see the union contract (if applicable) on the Division of Human Resources website at: http://www.hr.ri.gov/ or contact your human resources office.

Some job classifications require certification, training, registration, or the possession of a license as a condition of appointment and continued employment in that classification. They are defined in the job description for that classification as a Special Requirement. It is the responsibility of the employee to maintain the required certification, registration, or license at their own expense. Failure to maintain a certification, training, registration, or license required for continued employment as identified in the job specification may be subject to disciplinary action up to and including termination of employment.

The following employee types apply to the classified branch of state service only:

A change to employee’s eligibility to receive longevity payments was made by the Legislature in 2011. Prior to July 1, 2011, employees were eligible to receive longevity payments, that is, a percentage increase on their base rate based on total years of service.

Pursuant to RIGL 36-4-17.2, effective July 1, 2011 all further and future longevity increases for employees ceased. For some union employees this cut-off date was slightly later due to union contract provisions.

If an employee had previously accrued a longevity payment, the employee will continue to receive the same longevity payment that was in effect as of the cut-off date.

An employee in the classified or unclassified service who terminates employment and is subsequently reemployed by the state, would be eligible to receive an aggregate longevity increase for the period of initial employment.

Employees are paid on a bi-weekly basis following the State’s payroll schedule. An employee’s compensation is subject to all lawful deductions including but not limited to Social Security, Medicare, state and federal taxes, and pension contributions if applicable. In addition, there are voluntary deductions which may be elected upon enrollment in one or more voluntary benefit programs. Employees in a position that is represented by a bargaining organization may also elect to have membership dues deducted from their bi-weekly pay.

The State of Rhode Island’s payroll system is an exception-based system, meaning all exceptions to an employee’s scheduled work week and scheduled hours must be reported on their timesheets utilizing established exception codes. All exceptions must be authorized by an employee’s supervisor.

The State has mandated that an employee’s pay be directly deposited into a single account or two accounts of their choice. Note that an employee’s first pay will be in the form of a physical paycheck while State verifies the direct deposit information with the employee’s banking institution. Following the clearance of this pre-note process, an employee’s pay will be directly deposited into their approved banking institution. Following an employee’s first direct deposit, they may logon to PaystubRI at https://www.ri.gov/app/DOA/payroll/ to review their bi-weekly pay information as well as other relevant pay related information and notices.

Employees may also go to the Division of Human Resources website at http://www.hr.ri.gov for the official state calendar reflecting pay periods, pay days and official state holidays.

As stipulated in Personnel Rule 4.04, the step increase schedule differs for employees based on their status and is pre-determined by the salary range assigned to the specific classification.

In addition to step increases, Executive Branch employees, both union and non-union, may receive a pay plan increase as a result of collective bargaining negotiations. The amount and the effective date is determined by the State and must be approved by the Governor.

Note that salary increases will not be given while an employee is out on leave without pay with the exception of military leave. The salary increase will be given once the employee returns.

For more information regarding the employee status terminology found above, please review to Employee Status Types.

Workers' compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment. Beacon Mutual Insurance Company is the State’s third-party administrator (TPA) for our workers’ compensation program. Through this partnership, Beacon utilizes its state-of-the-art systems and seasoned, local adjusters, nurse case managers, disability managers and other claims professionals to manage the State employee workers’ compensation claims.

To reduce the risk of workplace injuries and afford State employees a safer working environment, Beacon also provides extensive loss prevention and training services. For more information, to include guidance and instructions on how to report a worksite injury, please visit the Beacon/State of RI website at: https://www.beaconmutual.com/state-of-rhode-island/. In addition to providing a general overview of the workers’ compensation program and the claims process, this site provides guidance on how to fill a prescription, find a doctor and answers frequently asked questions (FAQ’s).

All positions at the State are governed by the Fair Labor Standards Act (FLSA), Rhode Island labor laws, and state policies to ensure employees in exempt and nonexempt positions are classified correctly and paid appropriately. The Division of Human Resources is responsible for determining the classification of positions as exempt or nonexempt based on FLSA criteria and for ensuring that all employees are paid in accordance with federal and state laws.

Unlike hourly-paid FLSA nonexempt (standard) employees, FLSA exempt (non-standard) employees are accountable for their performance outcomes rather than for the number of hours or days worked and are not eligible for overtime pay. In recognition that occasionally a state of emergency or other extraordinary emergency-related event may result in an agency, department or work unit experiencing extraordinary time and effort well beyond the employees’ regular work schedule, the state has effectuated the ‘Exempt Position Compensatory Time’ policy. The purpose of this policy is to provide compensatory time in such circumstances for FLSA exempt employees, to include the guidelines under which the compensatory time will be authorized.

To read the full policy, click here: Exempt Position Compensatory Time Policy.

As required by the Americans with Disabilities Act and all other federal and state laws and regulations as well as applicable provisions of the collective bargaining agreements, the State of Rhode Island will provide reasonable accommodation to each “qualified individual with a disability” as defined in the Americans with Disabilities Act. A “qualified individual with a disability” is an employee or an applicant for employment who is able, with or without reasonable accommodation, to perform the essential functions of the position which the individual holds or applies.

The essential functions of a position are those which the incumbent must perform and are determined based upon the specific core functions assigned to that particular position. Essential job functions may vary among positions within the same classification title. Reasonable accommodation is a modification or adaption, which the employer can provide without undue hardship, which enables a qualified individual with a disability to perform the essential functions of the position.

An applicant for employment may request a reasonable accommodation during the recruitment and selection process by contacting the individual who coordinated the interview or other recruitment activity, or by calling the Human Resources main number at 401-222-2160 at least five (5) business days prior to the interview or other activity for which the applicant needs the accommodation.

An employee or applicant may request a reasonable accommodation for a civil service examination by calling the Human Resources main number at 401-222-2160 at least five (5) business days prior to the scheduled date of the test.

An applicant who receives a “conditional offer of employment” for a position in State service shall complete the “Self-Identification of Disability and Request for Reasonable Accommodation Request” form (CS-388-A) when accepting the offer. On that form, an applicant may choose to disclose that he/she has a disability and may request either a specific reasonable accommodation or a review of his/her need for a reasonable accommodation in order to perform the essential functions of the position for which he/she has been offered.

Current employees may request a reasonable accommodation in their current position or in a position which they have been offered by contacting the Disability Management Unit in the Division of Human Resources. This Unit may be reached through the Human Resources main line at 401-222-2160.

The state recognizes the growing demands on staff and increasing challenge of finding new and better ways to provide service and meet state and agency goals. Flexible work arrangements provide a way to successfully manage people, time, space and workload. The state supports flexible work arrangements to achieve a progressive and highly productive work environment that enables employees to balance work and personal needs while providing workforce predictability and stability.

An appointing authority at an agency is responsible for identifying and determining if a flexible work arrangement is feasible within their agency, to include a determination which group or groups may benefit from such an arrangement. Included in this consideration will be what is in the best interest of the agency and the state and if the flexible work arrangement increases productivity of the employee(s) as well as the efficiency of the operations of the agency.

In order for an employee to be considered for participation in an established flexible work arrangement, the employee must meet a number of establish criteria, to include but not limited to having been assigned at the agency and/or position for at least six months, demonstrated satisfactory performance and productivity, and having a satisfactory attendance record.

All flexible work arrangements and potential schedules must be approved by the Executive Director of Human Resources/Personnel Administrator prior to announcement and implementation.

The Flexible Work Arrangements Policy is located at https://rigov-policies.s3.amazonaws.com/HR_Flexible_Work_Arrangements_Policy_3-10-19.pdf and should be reviewed in full before a flexible work arrangement proposal is submitted for approval and to ensure compliance with policies standards.

The State’s Teleworking Policy provides a general framework for assessing and approving teleworking arrangements in Executive Branch State Agencies and is designed to assist managers and employees in understanding the teleworking program’s expectations and parameters.

Teleworking arrangements may provide for a more efficient and productive work environment for employees. However, telework is not suitable for all employees or positions, and therefore many employees and/or positions may be unable to participate in telework. Jobs that require independent work time, infrequent office-based face-to-face interaction, and have defined tasks with specific, measurable results are more suitable for telework.

In order for an employee to enter into a teleworking agreement, they must meet a number of program criteria, to include, but not limited to, having been assigned to an agency and position for at least six months, demonstrated satisfactory performance and productivity, be available for and attend on-site meetings during designated teleworking hours as necessary, be reachable by standard methods during regularly scheduled work hours and establish and maintain a dedicated home workspace.

To learn more about teleworking at the State, to include applicability, procedures for compliance, eligibility and the process to request a teleworking arrangement, review the full policy at: Teleworking Policy.

In the event that a building or worksite is not functioning within normal parameters and there is a health and safety concern for employees and/or the public, consideration may be made regarding the operation of the work location, including the relocation of personnel. The Building Closure policy establishes the parameters, expectations and accountability surrounding a compromised work location, to include the procedures for the requesting of a closure by an agency and the application of compensation for affected employees.

To view the full Building Closure policy, follow the attached link: DOA Building Closure Policy.

Space must be provided at individual departments that meets the necessary requirements for nursing mothers to breastfeed or express milk during working hours. The Nursing Mothers in State Employment policy establishes the authority, procedures, and expectations for both agencies and nursing mothers. The full policy can be found at: Nursing Mothers in State Employment Policy.

There may be times when a non-exempt or ‘standard’ employee (overtime eligible) is asked to travel on state business. In order to ensure compliance with government regulations and to establish the pay rules for different travel situations and compensable time periods, the Non-Exempt Travel Policy was established.

Found within this policy are the pay rules regarding travel during the workday, travel on a non-work day, travel for a one-day assignment, overnight travel, travel time as the driver of an automobile as well as travel time as a passenger.

To review the full Non-Exempt Travel Policy, please visit: Non-Exempt Travel Policy.

Your Base Entry date reflects your total length of service with the State of Rhode Island, not necessarily continuous. In computing length of service for longevity and leave accrual purposes prior full-time and part-time employment is counted.

State Representatives and Senators are given two years credit for each full term served and pages, doorkeepers and clerks of legislative committees are given 60 calendar days credit for each year served. Time employed as a board or commission member paid on a daily rate, or as an individual on a monthly payroll, or as a student in an assistance program at the State Colleges, is not counted toward the calculation of prior service credit.

Employees hired into classifications that mandate a Special Requirement for appointment or employees hired from a civil service list, must serve a six (6) month probationary period defined as 130 days worked in the class of position. Days not physically worked during a probationary period are not considered “worked” and will extend the end date of your probation.

Per RIGL § 36-4-28, at the expiration of the probationary period, the employee shall receive permanent status in the classification unless the Appointing Authority files a statement in writing with the Personnel Administrator that the services of the employee during the probationary period have not been satisfactory and that it is not desired that the employee be continued in the service.

For definitions of any of the above terminology, to include probationary and permanent, please refer to the Definitions of Commonly Used Terms linked here: http://www.hr.ri.gov/definitions.php.

You may also refer to the summary of the different employment statuses found within this Handbook here: State Employee Status Types.

The State of Rhode Island offers a robust and competitive benefits package that includes health coverage, group life insurance, deferred compensation, wellness programs, and much more. Visit the Office of Employee Benefits website at www.employeebenefits.ri.gov to explore the full scope of benefits programs. Decision support resources are also available on the website to help you choose the benefits package that is right for you.

Depending on whom your employer is and what position you hold, the Rhode Island General laws dictate what benefits you receive when you retire. These benefits may be different for people in high risk public service jobs, such as Police and Firemen, or may have unique provisions for counting service credit, as with Teachers. Employees’ Retirement System of Rhode Island (ERSRI) administrates about 21 different benefit structures, which may include Cost of Living Adjustments (COLA's) over time, or unique retirement eligibility conditions. For this reason, some public employees are entitled to different benefits than others. To understand and plan for your retirement, you should browse their web page to familiarize yourself with your retirement benefits.

For many employees, membership in the Employees’ Retirement System of Rhode Island (ERSRI) is compulsory. The majority of State employees are required to contribute 8.75% of their bi-weekly salary to the system. The State also makes a contribution to fund your retirement benefits.

Shortly after being hired, ERSRI will mail an enrollment application to your home. Once you have completed the enrollment application, it should be returned to ERSRI following the mailing instructions included with the enrollment application.

As you near retirement, the Employees' Retirement System of Rhode Island offers free retirement counseling at our offices and at 'outreach centers' around the state.

For more information, go to the Employees’ Retirement System of Rhode Island (ERSRI) website at: http://www.ersri.org/#gsc.tab=0

In compliance with the US DOT and Federal Motor Carriers Safety Administration requirements of the Omnibus Transportation Employee Testing Act of 1991, the State of Rhode Island has a Policy and Procedures Guide for Drug and Alcohol Testing of Commercial Driver’s License Holders that details our alcohol and drug testing program for employees within state service who are required to possess a Commercial Drivers License (CDL) as a job requirement.

The State of Rhode Island, as a recipient of federal funding, is mandated to comply with all aspects of these federal agency’s promulgated rules and regulations.

For further information and details, see the State’s Policy and Procedures Guide for Drug and Alcohol Testing of Commercial Driver’s License Holders available at http://www.hr.ri.gov.

The State is committed to providing a safe, healthy and productive work environment for all employees. Consistent with this commitment, the State must prohibit substance use which harms the health and well-being of its employees, inhibits the execution of their duties, or interferes with their service to the public. The State also recognizes that addiction is a chronic disease of the brain and that employees affected by addiction can make a full recovery from substance use disorder with treatment and family and community support. It is therefore, the policy of the State to:

To read the full policy, click on the following link: Substance Free Workplace Policy.

The State of Rhode Island is committed to providing and maintaining a safe, healthy and secure work environment, characterized by courtesy, respect and professionalism, that is free from workplace violence. Therefore, the State has adopted a statewide zero tolerance policy for workplace violence.

Accordingly, the purpose of this policy is to:

To view the full policy, click on the following link: Violence Prevention in the Workplace

Employees are eligible for vacation leave according to their length of service as stipulated by Personnel Rule 5.0614. Employees shall accrue vacation leave on an hourly basis according to the following schedule:

| Years of Service | Accrual Rate |

|---|---|

| 0 - <5 | 0.0308 |

| 5 - <10 | 0.0500 |

| 10 - <15 | 0.0538 |

| 15 - <20 | 0.0615 |

| 20 - <25 | 0.0654 |

| 25 + | 0.0731 |

| Accrual Per Pay Period (35.0 Hrs) | Upfront Hours | Total Hours per Year |

|---|---|---|

| 2.2 | 14.0 | 70 |

| 3.5 | 14.0 | 105 |

| 3.8 | 28.0 | 126 |

| 4.3 | 28.0 | 140 |

| 4.6 | 63.0 | 182 |

| 5.1 | 63.0 | 196 |

| Years of Service | Accrual Rate |

|---|---|

| 0 - <5 | 0.0308 |

| 5 - <10 | 0.0500 |

| 10 - <15 | 0.0538 |

| 15 - <20 | 0.0615 |

| 20 - <25 | 0.0654 |

| 25 + | 0.0731 |

| Accrual Per Pay Period (40.0 Hrs) | Upfront Hours | Total Hours per Year |

|---|---|---|

| 2.5 | 16.0 | 80 |

| 4.0 | 16.0 | 120 |

| 4.3 | 32.0 | 144 |

| 4.9 | 32.0 | 160 |

| 5.2 | 72.0 | 208 |

| 5.8 | 72.0 | 224 |

“Upfront hours” are credited on the date you first begin employment with the State and on January 1st every year thereafter. The number of upfront hours credited is based on an employee’s total years of service with the State (calculated from the employee’s “Base Entry Date” recorded on the Personnel Action CS-3 form) as indicated in the chart above.

Vacation leave does not accrue for any time during which an employee is on leave without pay.

Employees who have a combined total of 20 years of state and municipal service in Rhode Island will be credited with five additional vacation days. A Certification of Municipal Service form must be completed and approved in advance of receiving credit and can be obtained from the human resources office. The completed form must be submitted to your human resources office for submission to the Office of the Personnel Administrator for review and approval.

The accrual year shall end on the last day of the last full biweekly pay period in the calendar year.

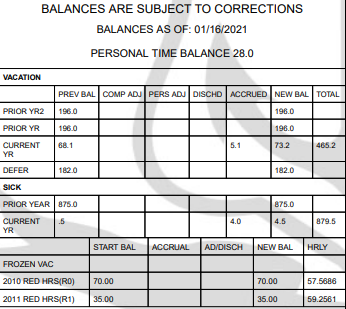

Accrued hour balances are recorded on direct deposit receipts and may be viewed on PayStub RI.

On your paystub, there are three ‘buckets’ of vacation accruals. The Current Year bucket reflects the current years accruals (Accrued & Discharged), to include your previous balance from the last pay period, any hours discharged or used for that pay period (Discharge), and your biweekly accrual for the current pay period. New Balance is the sum of Previous Balance and Accrued minus Discharge and is paid out upon separation from State service.

Prior Year2 bucket holds up to one year of accruals that were carried over from previous year(s). New Balance is paid out upon separation from State service.

The Prior Year bucket holds up to one year of accruals and has no cash value, meaning it does not get paid out upon separation from State service.

The Total Column is the sum of the New Balance from all three “buckets” Current Year, Prior Year2 and Prior Year.

At the end of each accrual year, up to one-year of accruals from the New Balance in Current Year moves to Prior Year2. If there is any excess over one-year of accruals in the Prior Year2 bucket, then up to one year of the excess is moved into Prior Year. Any accruals in excess of the total two year carry over is not eligible to carry into the new year and will be lost (known as ‘Use or Lose’).

When vacation hours are discharged, the hours will be deducted from the Prior Year bucket first, if none, then from the Current bucket, and if none, from the Prior Year2 bucket.

Pers Adjustments are corrections made to an employee’s vacation accrual due to a late/amended timesheet. Comp Adjustments are automatically generated by the payroll system when an employee acquires the next Years of Service level and is eligible for additional upfront hours or at the beginning of September when the computer automatically generates the adjustment needed to ensure the employee is credited with the correct number of Total Hours per Year.

When an employee leaves state service, to include retirement, termination, resignation, death, or dismissal, the employee or their estate is entitled to be paid any accrued vacation in the Prior Year2 and Current Year bucket. Hours in Prior Year bucket are not payable upon termination/retirement.

If an employee has any hours in the ‘DEFER’ bucket (also known as “Sundlun Days”), this amount will be paid out upon separation from state service at the employee’s current rate of pay.

If an employee has any hours in the ‘FROZEN VAC’ bucket, this amount will be paid out upon separation from state service at the employee’s current rate of pay.

If an employee has any hours in the R0 and/or R1 buckets and they leave state service for any action other than dismissal, up to four (4) days of the R0 and/or up to four (4) days of the R1 hours will be paid at the hourly rate associated with the ‘R’ hours. If an employee is dismissed from state service, they will not receive any payout for R0 or R1 hours that remain.

The State’s Accrual System is the system of record when determining an employee’s vacation payout due.

The discharge of accrued vacation leave must be requested and approved in advance and in accordance with the policy and procedures in effect at the employee’s workplace.

Sick Leave is defined to mean a necessary absence from duty due to illness, injury, exposure to contagious disease, pregnancy or childbirth and may include absence due to illness in the employee’s immediate family. As set forth in more detail below, employees are required to submit documentary evidence which reasonably establishes the medical necessity of an absence.

Employees in a 35-hour workweek accrue four (4) hours of paid sick leave for every two (2) weeks of work up to a maximum of 875 hours. Employees in a 40-hour workweek accrue five (5) hours of paid sick leave for every two (2) weeks of work up to a maximum of 1,000 hours. Paid sick leave does not accrue for any time when the employee is on leave without pay. The employee’s sick leave accrual balance is recorded on the direct deposit receipts on PayStub RI.

Personnel Rule 5.06231 and collective bargaining agreements define “immediate family” to include: spouse, domestic partner, child (including foster child), brother, sister, parent, parent-in-law, grandparent or other relative residing in the employee’s household. Note that the Family Medical Leave Act (FMLA) provides for leave to care for a spouse, child under age 19 (including a foster child), adult child incapable of self-care, parent or parent-in-law with a serious health condition.

Pursuant to Personnel Rule 5.0623, an employee may discharge up to twenty (20) days of sick leave in a calendar to care for a family member. If the absence to care for a family member exceeds twenty (20) days, the employee may discharge vacation or personal leave.

Employees must notify their immediate supervisor of their absence as soon as the employee knows of the necessity of the absence, and the employee must follow the notice procedure in place in the employee’s work unit. The employee must provide advance notice of medical treatment or medical appointments which are scheduled in advance of the absence.

For a medical absence of more than three (3) days but less than five (5) days, the employee may submit either a note or other document from his or her treatment provider or a properly completed “Employee Certification of Necessary Absence” form. This form may be printed from the State’s Human Resources website (www.hr.ri.gov).

For medical absences of five (5) days or more, the employee must submit a note or other document from their treatment provider. The document must present sufficient medical facts to establish the medical necessity of the absence, together with the anticipated duration of the absence. If the anticipated duration is unknown, the treatment provider must indicate the next date when the provider will evaluate the employee’s work status.

An employee may apply for leave under the Family Medical Leave Act (FMLA). Based upon the employee’s previous hours worked and the information provided by the treatment provider on the required medical certification form, Human Resources will determine whether the employee is eligible for FMLA leave, whether the absence qualifies for FMLA leave and the duration of the FMLA leave which is approved. If the employee is approved for FMLA, an employee will be required to discharge accrued leave as stipulated in the State Family Medical Leave Act policy found here: https://rigov-policies.s3.amazonaws.com/HR_FMLA_Policy_6-6-17.pdf

The State may require that the treatment provider verify or clarify any medical document submitted by an employee in support of the employee’s absence and may require specific medical documentation in cases of excessive absenteeism, unauthorized absence, or a pattern of sick leave abuse.

When an employee returns to work from a medical absence of five (5) days or longer, the employee must submit a release from the treatment provider clearing the employee to return to work. The treatment provider may release the employee to return to work “full duty, no restrictions”. If the employee is released with restrictions, the treatment provider must identify the restrictions with sufficient specificity that the employee’s supervisors can determine whether they can accommodate those restrictions.

Upon written application, employees may be granted a leave without pay, not to exceed one year, for reason of personal illness, disability, educational improvement or other purpose deemed proper and approved by the Appointing Authority and Executive Director of Human Resources/Personnel Administrator. The employee who applies for such a leave will be required to submit acceptable documentation in support of his/her application for such a leave.

Upon the expiration of an authorized leave of absence, the employee shall be returned to the position which (s)he occupied at the time the leave became effective, subject to the law and rules. Failure of an employee to report for duty promptly at the expiration of such leave is just cause for dismissal.

State employees will not be granted a leave of absence to accept employment outside of state service.

If you are seeking a leave for the reason of a personal illness or disability, please contact the Disability Management Unit (DMU). The DMU, with notice to the appointing authority and the Executive Director of Human Resources/Personnel Administrator, may place an employee on a “Personal Illness” leave of absence upon receipt of medical certification which establishes the medical necessity of such a leave. DMU, with the approval of the appointing authority and the Executive Director of Human Resources/Personnel Administrator, may also place an employee on a “Personal Illness” leave of absence when an employee is unable to perform the essential functions of his/her position so that the employee may obtain medical treatment to enable the employee to return to work and to perform the essential functions of his/her position. A “Personal Illness” leave of absence is subject to the periodic submission of medical certification which establishes the medical necessity of the employee’s continued absence and the reasonable likelihood that the employee will return to work and will perform his/her job duties at the conclusion of the leave of absence.

An employee may submit a request to the payroll representative designated for their agency for approval to be advanced up to eighty (80) hours of sick leave with pay, provided that all leave accruals have been exhausted and the employee agrees that future accruals of sick leave shall be applied against such advance until the balance is reimbursed.

An employee may request up to an additional eighty (80) hours of sick leave with pay. This request must be submitted to the payroll representative for approval by the Executive Director of Human Resources and notice to the Controller, provided that all leave accruals have been exhausted and the employee agrees that future accruals of sick leave shall be applied against such advance until the balance is reimbursed.

In all such cases, satisfactory medical evidence is required in support of the request. In addition, length of service and attendance history is taken into consideration when reviewing such requests for approval.

For an up-to-date listing of human resources representatives, to include the payroll representative for each agency within the Executive Branch, please visit: http://www.hr.ri.gov/about/programs/.

Most union contracts provide for the establishment and operation of a Sick Leave Bank managed by a joint labor/management committee. Sick Leave Banks afford an opportunity for eligible employees dealing with catastrophic personal illness or injury (not job related) to obtain additional sick leave hours when all other accrued leave has been exhausted. Sick Leave Banks may not be utilized for illness or injuries incurred by family members.

The labor/management committee must require adequate evidence of the employee’s catastrophic illness or injury, which is not job related. Sick leave bank hours will not be granted to an applicant with evidence of prior sick leave abuse in his/her personnel file or attendance record. Prior utilization of sick leave does not by itself indicate sick leave abuse.

Union members make contributions to the Sick Leave Bank during the donation drives. Any employee who does not make a contribution is not eligible to apply to the Bank for any sick leave.

Members who wish to be eligible to apply to the bank must contribute eight (8) hours of sick leave if assigned to a forty (40) hour work week or seven (7) hours of sick leave if assigned to a thirty-five (35) hour work week.

The maximum amount of sick leave that may be granted is 480 hours for an employee assigned to a forty (40) hour work week or 420 hours for an employee assigned to a thirty-five (35) hour work week.

Part-time employees may participate on a pro-rata basis.

Nothing herein contradicts or restricts an employee’s entitlement to FMLA leave. In addition, the discharge of sick leave bank hours granted shall be counted towards an employee’s entitlement under FMLA.

For more information, see the union contract (if applicable) on the Division of Human Resources website at http://www.hr.ri.gov or contact your human resources office.

Eligible employees with a qualifying reason shall be granted leave under the Federal Family Medical Leave Act (“FMLA”) and/or the Rhode Island Parental and Family Medical Leave Act (the “State Act”) for up to thirteen (13) weeks in a calendar year.

An employee is “eligible” for leave under the FMLA when he/she has worked for the State for at least one (1) year and has worked 1,250 hours within the twelve months immediately before the beginning date of the requested leave. An employee is “eligible” for leave under the State Act if the employee has worked for the State for at least twelve consecutive months.

An eligible employee will be granted FMLA leave under the Federal law and the State Act for any of the following reasons:

An eligible employee will also qualify for FMLA leave to care for a covered member of the military service who sustained or aggravated a serious injury or illness in the line of duty while on active duty, or to tend to a qualifying exigency arising out of a covered military member’s commitment to duty under a call or order to active duty.

An eligible employee with a qualifying reason for leave may be approved to take that leave in the following forms:

The “serious health condition” of the employee or a family member is determined based upon the medical certification of the employee’s or family member’s treatment provider. The treatment provider may complete and sign the FMLA medical certification form (The WH-380-E for an employee or the WH-380-F for a family member.) The State may also accept other written documentation from the treatment provider which reasonably establishes that the employee’s absence is medically necessary due to the serious medical condition of the employee or family member. The medical document must state the anticipated duration of the employee’s continuous absence, or the anticipated frequency and duration of episodes of intermittent absence, or the anticipated duration of the need for a reduced work schedule.

On January 1st of each year, the state shall credit each employee hours equivalent to four (4) working days leave with pay, per calendar year, to be used for personal business and/or religious observance. The discharge of personal leave must be requested and approved in advance and in accordance with the policy and procedures in effect at the employee’s workplace.

For the first calendar year of employment, employees hired between the dates show below shall receive hours equivalent to:

January 1 and March 31 - four (4) days

April 1 and June 30 - three (3) days

July 1 and September 30 - two (2) days

October 1 and December 31 - one (1) day

Personal leave may not be carried from year to year, nor are employees compensated upon termination of employment.

Refer to your union contract (if applicable) for further information.

In the event of a death in the employee’s family, the employee shall be entitled to absence with full pay not chargeable to the employee’s sick leave accumulation for:

If more than the above days of bereavement leave are needed, such additional time must be charged to annual or personal leave.

NOTE: Some union contracts contain provisions which may differ from the above. Union members are encouraged to check their applicable union contract.

At the State of Rhode Island, each classification is assigned one of four basic workweeks as follows:

Each position is also assigned a total number of scheduled hours per week which indicates whether the position is full or part time and is the basis for leave accruals and service credit.